Calculate medicare tax 2023

This Tax Return and Refund Estimator is currently based on 2022 tax tables. The current tax rate for social security is 62 for the employer and 62 for the employee or 124.

How The Medicare Tax Rate Is Changing Medicarefaq

It will be updated with 2023 tax year data as soon the data is available from the IRS.

. A 1656 benefit is short about 4380 per. 2021 Tax Calculator Exit. 2023452 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations.

Days 101 and beyond. The 2023 tax calculator is designed to provide quick income tax calculations and salary examples. The tool is continually developed and refined in response to community.

The Medicare Tax is an additional 09 in tax an individual or couple must pay on income thresholds above 200000 for singles and 250000 for couples. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Use this calculator to estimate your self-employment taxes.

Medicare tax calculator 2023 Jumat 09 September 2022 This calculator includes the 38 Medicare contribution tax on the lesser of a net investment income or b modified. 4 hours agoSocial Security recipients can calculate the increase by taking their gross. You pay all costs.

Employers and employees split the tax. Start the TAXstimator Then select your IRS Tax Return Filing. Based on the Information you entered on this 2021 Tax Calculator you.

To get assistance under the Affordable Care Act you must earn between 100 400 of the poverty level. People who owe this. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Self-employed people are allowed to deduct their health insurance premiums on Schedule 1 of the 1040 form as an above the line deduction. 0 for covered home health care services. Prepare and e-File your.

The 2023 tax calculator is designed to provide quick income tax calculations and salary. Calculate Your 2023 Tax Refund. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

Normally these taxes are withheld by your employer. For both of them the current Social Security and Medicare tax rates are 62 and 145. As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022.

The income on your 2021 tax return to be filed in 2022. Prepare and e-File your. Medicare Advantage plans as low as 0month.

Calculate Your 2023 Tax Refund. It will be updated with 2023 tax year data as soon the data is available from the IRS. Ad Get Your Copy of Bloomberg Taxs 2023 Projected US Tax Rates Special Report.

This calculator includes the 38 Medicare contribution tax on the lesser of a net investment income or b modified adjusted gross income exceeding a threshold based on your tax filing. Heres what you need to know. Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status without regard to whether any tax was withheld.

Based on inflation through August we calculate that the COLA for August 2023 has fallen short on average by 48 she added. 2022 Self-Employed Tax Calculator for 2023. Remember the income on your 2020 tax return AGI plus muni interest determines the IRMAA you pay in 2022.

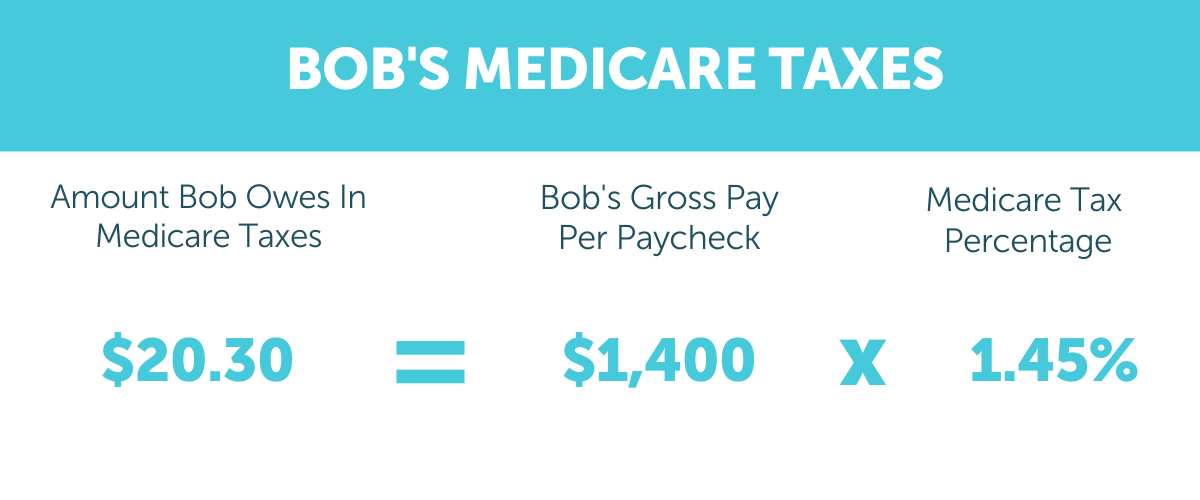

How Do You Calculate Medicare Tax. 19450 copayment each day. The current rate for Medicare is 145 for the employer and 145.

Start Crafting Money-Saving Tax Strategies for Clients with Our 2023 Projected Tax Rates. However if you are. For 2023 that is 13590-54360 for an individual and 27750-.

What is a 202345k after tax.

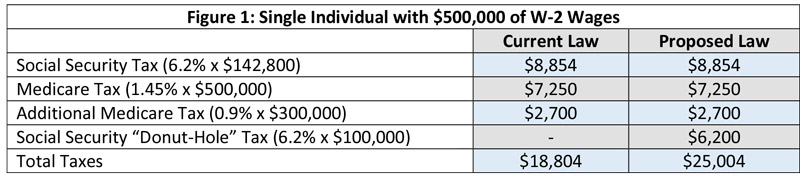

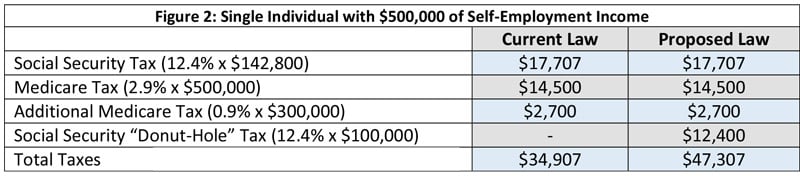

Biden S Payroll Tax Hike Plan Beyond The Donut Hole Thinkadvisor

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

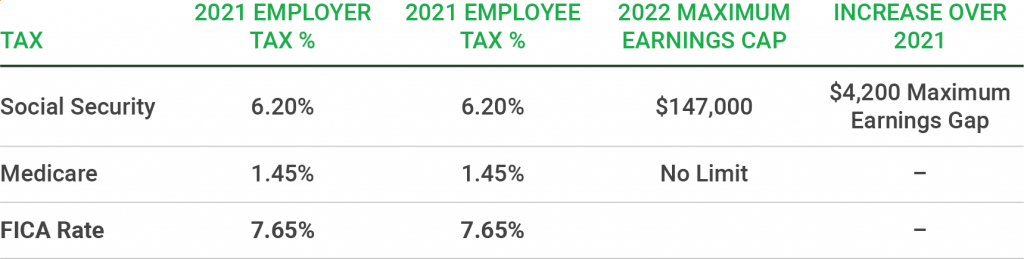

2022 Federal State Payroll Tax Rates For Employers

Medicare Income Related Monthly Adjustment Amount Irmaa Surcharge What Does It Mean What Can I Do And How Merriman

Social Security Payroll Tax Here S How Much The Average American Will Owe In 2018 The Motley Fool

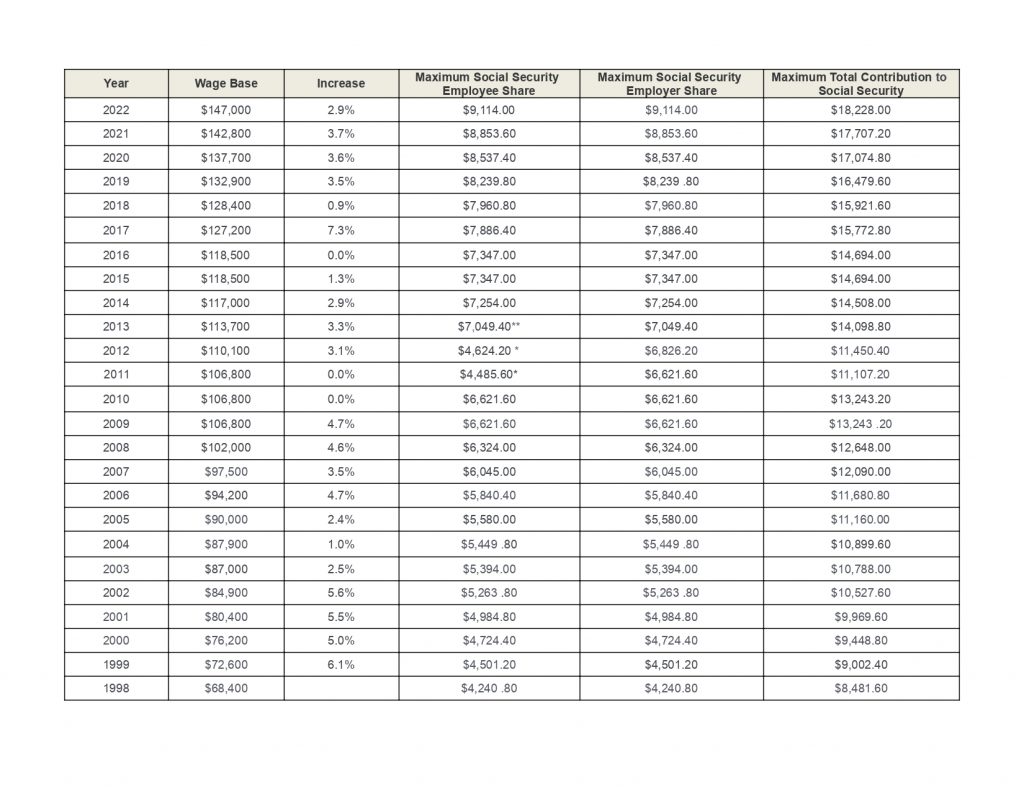

Social Security Wage Base 2021 And Updated For 2022 Uzio Inc

Medicare Part B Premiums For 2022 Jump By 14 5 From This Year Far Above The Estimated Rise In Cost Medicare Required Minimum Distribution Tax Brackets

Are Medicare Premiums Tax Deductible In 2021 Medicarefaq

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Easiest 2021 Fica Tax Calculator

How To Calculate Medicare Tax Withholding For Single Persons And Married Couples And Self Employed Youtube

Ho9hyilrllpdfm

How To Calculate Medicare Tax Withholding For Single Persons And Married Couples And Self Employed Youtube

Social Security Administration Announces 2022 Payroll Tax Increase Eri Economic Research Institute

Biden S Payroll Tax Hike Plan Beyond The Donut Hole Thinkadvisor

Will Selling My Home Affect My Medicare Clearmatch Medicare

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll